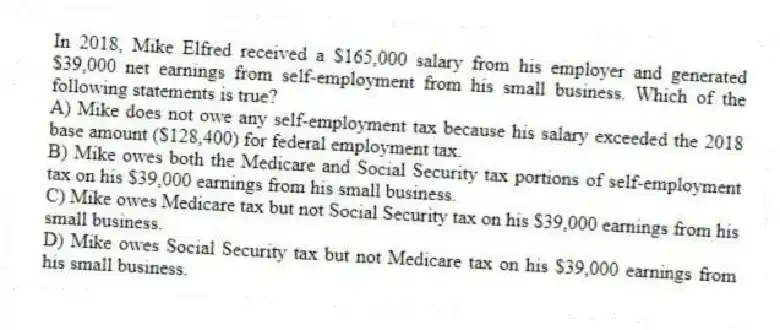

In 2018, Mike Elfred received a $165,000 salary from his employer and generated $39,000 net earnings from self-employment from his small business. Which of the following statements is true?

A) Mike does not owe any self-employment tax because his salary exceeded the 2018 base amount ($128,400) for federal employment tax.

B) Mike owes both the Medicare and Social Security tax portions of self-employment tax on his $39,000 earnings from his small business.

C) Mike owes Medicare tax but not Social Security tax on his $39,000 earnings from his small business.

D) Mike owes Social Security tax but not Medicare tax on his $39,000 earnings from his small business.

Correct Answer:

Verified

Q42: Which of the following amounts are not

Q44: Which of the following statements regarding a

Q45: Which of the following statements about partnerships

Q47: Sue's 2018 net (take-home) pay was $23,205.

Q48: Which of the following statements concerning partnerships

Q49: During 2018, Scott Howell received a salary

Q51: Armond earned $10,000 of profit from a

Q51: During the current year, Margie earned wage

Q53: William is a member of an LLC.

Q55: Alice is a partner in Axel Partnership.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents