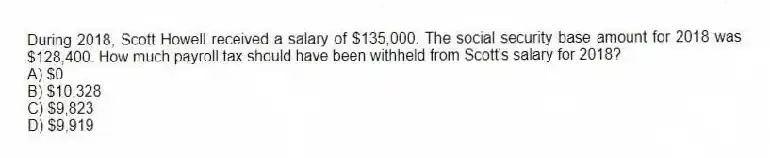

During 2018, Scott Howell received a salary of $135,000. The social security base amount for 2018 was $128,400. How much payroll tax should have been withheld from Scott's salary for 2018?

A) $0

B) $10,328

C) $9,823

D) $9,919

Correct Answer:

Verified

Q45: During 2018, Elena generated $24,500 of earnings

Q45: Which of the following statements about partnerships

Q46: Hay, Straw and Clover formed the HSC

Q47: Sue's 2018 net (take-home) pay was $23,205.

Q48: Which of the following statements concerning partnerships

Q51: Armond earned $10,000 of profit from a

Q51: During the current year, Margie earned wage

Q52: In 2018, Mike Elfred received a $165,000

Q53: William is a member of an LLC.

Q56: Alan is a general partner in ADK

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents