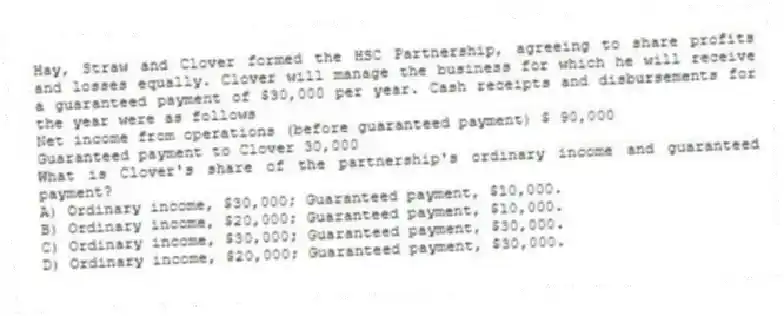

Hay, Straw and Clover formed the HSC Partnership, agreeing to share profits and losses equally. Clover will manage the business for which he will receive a guaranteed payment of $30,000 per year. Cash receipts and disbursements for the year were as follows

Net income from operations (before guaranteed payment) $ 90,000

Guaranteed payment to Clover 30,000

What is Clover's share of the partnership's ordinary income and guaranteed payment?

A) Ordinary income, $30,000; Guaranteed payment, $10,000.

B) Ordinary income, $20,000; Guaranteed payment, $10,000.

C) Ordinary income, $30,000; Guaranteed payment, $30,000.

D) Ordinary income, $20,000; Guaranteed payment, $30,000.

Correct Answer:

Verified

Q21: Which of the following statements regarding the

Q41: Waters Corporation is an S corporation

Q44: Martha Pim is a general partner in

Q45: During 2018, Elena generated $24,500 of earnings

Q45: Which of the following statements about partnerships

Q47: Sue's 2018 net (take-home) pay was $23,205.

Q49: During 2018, Scott Howell received a salary

Q51: Armond earned $10,000 of profit from a

Q53: William is a member of an LLC.

Q56: Alan is a general partner in ADK

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents