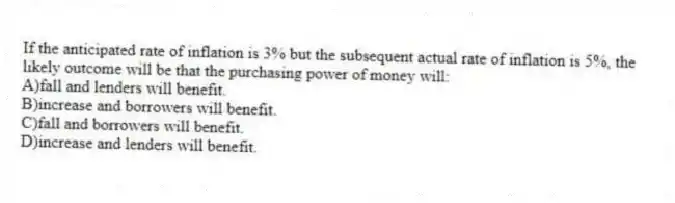

If the anticipated rate of inflation is 3% but the subsequent actual rate of inflation is 5%, the likely outcome will be that the purchasing power of money will:

A) fall and lenders will benefit.

B) increase and borrowers will benefit.

C) fall and borrowers will benefit.

D) increase and lenders will benefit.

Correct Answer:

Verified

Q50: The 'real rate' of interest is the:

A)nominal

Q51: Looking at the following table, what is

Q52: If the nominal rate of interest is

Q53: Inflation that is _ than what is

Q54: Looking at the following table, what is

Q56: Looking at the following table, what is

Q57: If you want to earn a real

Q58: Looking at the following table, real average

Q59: If the nominal interest rate is 8%

Q60: Using the following table, calculate real average

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents