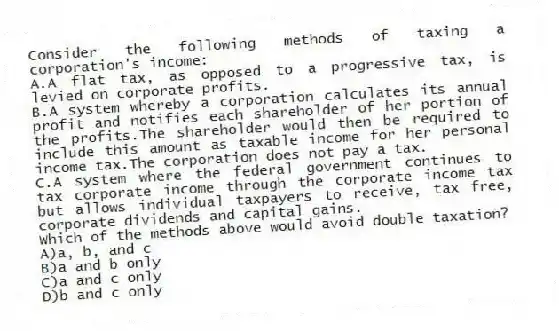

Consider the following methods of taxing a corporation's income:

A.A flat tax, as opposed to a progressive tax, is levied on corporate profits.

B.A system whereby a corporation calculates its annual profit and notifies each shareholder of her portion of the profits.The shareholder would then be required to include this amount as taxable income for her personal income tax.The corporation does not pay a tax.

C.A system where the federal government continues to tax corporate income through the corporate income tax but allows individual taxpayers to receive, tax free, corporate dividends and capital gains.

Which of the methods above would avoid double taxation?

A) a, b, and c

B) a and b only

C) a and c only

D) b and c only

Correct Answer:

Verified

Q159: The complexity of the U.S.federal income tax

Q160: Suppose the government imposes an 8 percent

Q161: Figure 18-2 Q162: Figure 18-2 Q163: Figure 18-2 Q165: Figure 18-2 Q166: The corporate income tax is ultimately paid Q167: Figure 18-1 Q168: A CBO study estimated that the excess Q169: Figure 18-2 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()

![]()

![]()

![]()