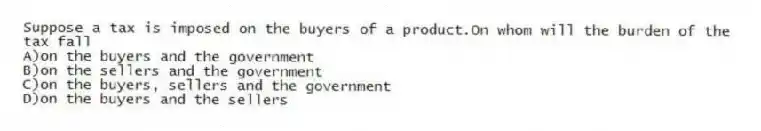

Suppose a tax is imposed on the buyers of a product.On whom will the burden of the tax fall

A) on the buyers and the government

B) on the sellers and the government

C) on the buyers, sellers and the government

D) on the buyers and the sellers

Correct Answer:

Verified

Q10: What effect does a tax on a

Q11: What effect does a tax placed on

Q12: Which outcome will occur as a result

Q13: When a good is taxed,are buyers and

Q14: What should be used to analyze economic

Q16: A tax is imposed on a market

Q17: What effect does a tax placed on

Q18: If a tax is imposed on the

Q19: When a tax is placed on the

Q20: What effect does a tax levied on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents