Multiple Choice

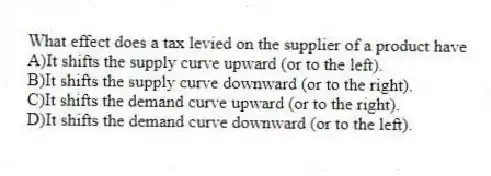

What effect does a tax levied on the supplier of a product have

A) It shifts the supply curve upward (or to the left) .

B) It shifts the supply curve downward (or to the right) .

C) It shifts the demand curve upward (or to the right) .

D) It shifts the demand curve downward (or to the left) .

Correct Answer:

Verified

Related Questions

Q15: Suppose a tax is imposed on the

Q16: A tax is imposed on a market

Q17: What effect does a tax placed on

Q18: If a tax is imposed on the

Q19: When a tax is placed on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents