Multiple Choice

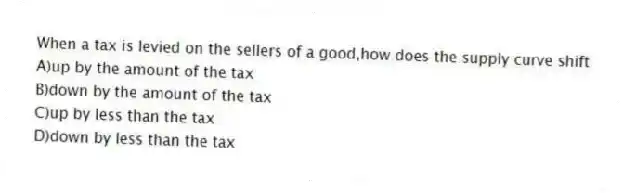

When a tax is levied on the sellers of a good,how does the supply curve shift

A) up by the amount of the tax

B) down by the amount of the tax

C) up by less than the tax

D) down by less than the tax

Correct Answer:

Verified

Related Questions

Q20: What effect does a tax levied on

Q21: Figure 8-1 Q22: Figure 8-2 Q23: Suppose a $2 tax is placed on Q24: Who bears the burden of a tax Q26: Figure 8-1 Q27: How is the benefit received by buyers Q28: How is the tax benefit received by Q29: Figure 8-2 Q30: How is tax burden related to the Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()

![]()