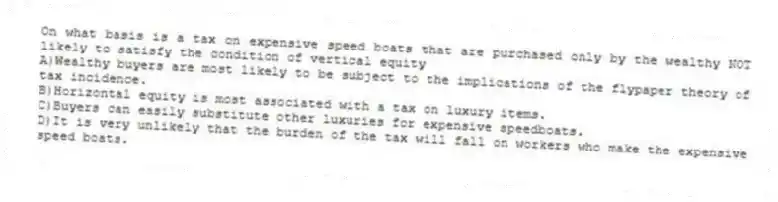

On what basis is a tax on expensive speed boats that are purchased only by the wealthy NOT likely to satisfy the condition of vertical equity

A) Wealthy buyers are most likely to be subject to the implications of the flypaper theory of tax incidence.

B) Horizontal equity is most associated with a tax on luxury items.

C) Buyers can easily substitute other luxuries for expensive speedboats.

D) It is very unlikely that the burden of the tax will fall on workers who make the expensive speed boats.

Correct Answer:

Verified

Q25: Resources devoted to complying with the tax

Q174: How do policymakers consider goals of efficiency

Q175: When a tax does not have a

Q176: The efficiency of a tax system refers

Q177: What does tax incidence refer to

A)what product

Q178: Which statement best describes the flypaper theory

Q181: List the three most important expenditure programs

Q182: A recent increase in federal gasoline taxes

Q183: What is the difference between vertical equity

Q184: Why is corporate tax popular among voters

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents