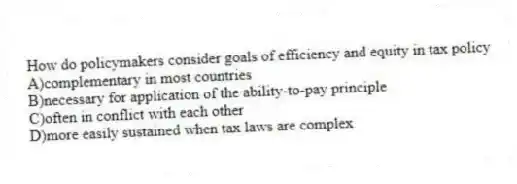

How do policymakers consider goals of efficiency and equity in tax policy

A) complementary in most countries

B) necessary for application of the ability-to-pay principle

C) often in conflict with each other

D) more easily sustained when tax laws are complex

Correct Answer:

Verified

Q169: When the government levies a tax on

Q170: Deadweight losses arise because a tax causes

Q171: The most important taxes for provincial and

Q172: A corporate tax on the income of

Q173: The most important taxes for the federal

Q175: When a tax does not have a

Q176: The efficiency of a tax system refers

Q177: What does tax incidence refer to

A)what product

Q178: Which statement best describes the flypaper theory

Q179: On what basis is a tax on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents