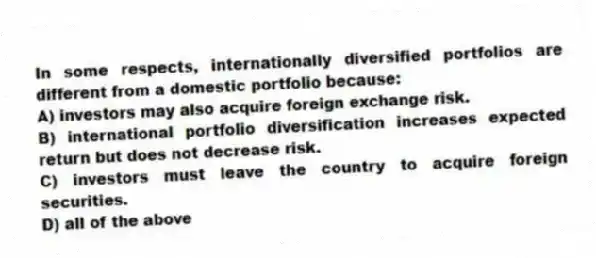

In some respects, internationally diversified portfolios are different from a domestic portfolio because:

A) investors may also acquire foreign exchange risk.

B) international portfolio diversification increases expected return but does not decrease risk.

C) investors must leave the country to acquire foreign securities.

D) all of the above

Correct Answer:

Verified

Q27: The WACC is usually used as the

Q28: Firms acquire debt in either the form

Q29: In some respects, internationally diversified portfolios are

Q30: A fully diversified domestic portfolio has a

Q31: A well-diversified portfolio has about _ of

Q33: An internationally diversified portfolio:

A) should result in

Q34: A U.S. investor makes an investment in

Q35: In general, the geometric mean will be

Q36: If a firm's expected returns are more

Q37: The beginning share price for a security

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents