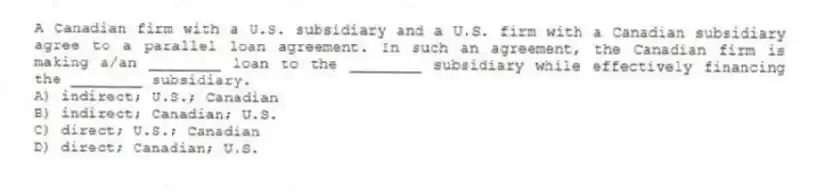

A Canadian firm with a U.S. subsidiary and a U.S. firm with a Canadian subsidiary agree to a parallel loan agreement. In such an agreement, the Canadian firm is making a/an ________ loan to the ________ subsidiary while effectively financing the ________ subsidiary.

A) indirect; U.S.; Canadian

B) indirect; Canadian; U.S.

C) direct; U.S.; Canadian

D) direct; Canadian; U.S.

Correct Answer:

Verified

Q48: Swap agreements are treated as off-balance sheet

Q49: Most swap dealers arrange swaps so that

Q50: A _ occurs when two business firms

Q51: A British firm has a subsidiary in

Q52: The empirical evidence strongly supports the proposition

Q53: A _ resembles a back-to-back loan except

Q54: Which of the following is NOT an

Q55: After being introduced in the 1980s, currency

Q56: NorthRim Inc. (NRI), imports extreme condition outdoor

Q57: After being introduced in the 1980s, currency

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents