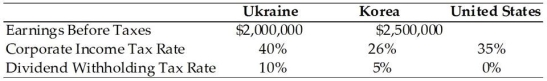

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea set the payout rate from the Ukraine subsidiary at 25%, how should BayArea set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill?

A) 28.5%

B) 24.5%

C) 42.6%

D) 82.3%

Correct Answer:

Verified

Q20: A tax that is a form of

Q21: Explain the worldwide and territorial approaches of

Q22: A _ is a direct reduction of

Q23: TABLE 15.1

Use the information to answer following

Q24: What is a value-added tax? Where is

Q26: Between 2006-2012, global corporate tax rates have

Q27: FEW governments rely on income taxes, both

Q28: TABLE 15.1

Use the information to answer following

Q29: Use the information to answer the following

Q71: Transfer pricing is a strategy that may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents