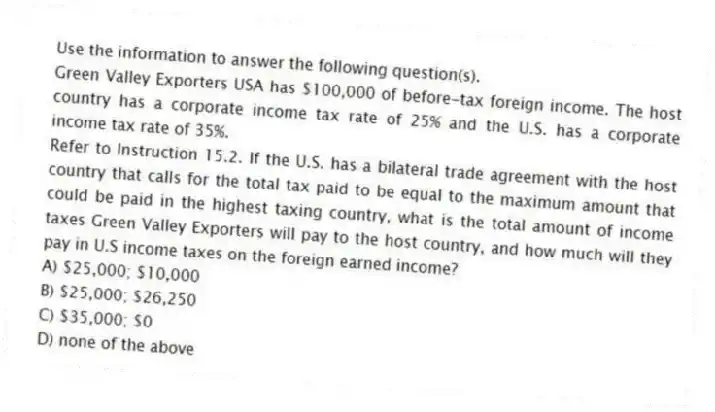

Use the information to answer the following question(s) .

Green Valley Exporters USA has $100,000 of before-tax foreign income. The host country has a corporate income tax rate of 25% and the U.S. has a corporate income tax rate of 35%.

-Refer to Instruction 15.2. If the U.S. has a bilateral trade agreement with the host country that calls for the total tax paid to be equal to the maximum amount that could be paid in the highest taxing country, what is the total amount of income taxes Green Valley Exporters will pay to the host country, and how much will they pay in U.S income taxes on the foreign earned income?

A) $25,000; $10,000

B) $25,000; $26,250

C) $35,000; $0

D) none of the above

Correct Answer:

Verified

Q24: What is a value-added tax? Where is

Q25: TABLE 15.1

Use the information to answer following

Q26: Between 2006-2012, global corporate tax rates have

Q27: FEW governments rely on income taxes, both

Q28: TABLE 15.1

Use the information to answer following

Q31: Of the OECD 30 countries, most employ

Q32: Use the information to answer the following

Q33: Use the information to answer the following

Q34: The worldwide approach, also referred to as

Q71: Transfer pricing is a strategy that may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents