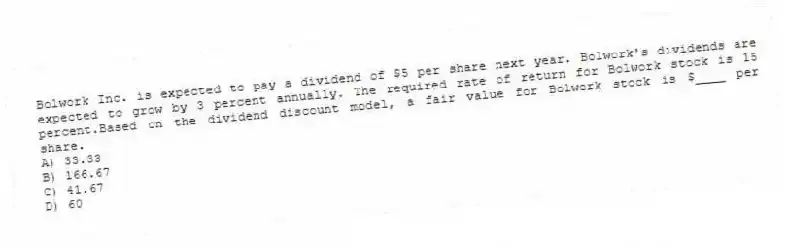

Bolwork Inc. is expected to pay a dividend of $5 per share next year. Bolwork's dividends are expected to grow by 3 percent annually. The required rate of return for Bolwork stock is 15 percent.Based on the dividend discount model, a fair value for Bolwork stock is $____ per share.

A) 33.33

B) 166.67

C) 41.67

D) 60

Correct Answer:

Verified

Q4: The limitations of the dividend discount model

Q5: The _ is commonly used as a

Q6: The _ index can be used to

Q10: A weak dollar may enhance the value

Q11: If security markets are semistrong-form efficient, investors

Q12: If security prices fully reflect all market-related

Q13: A stock's average return is 10 percent.

Q15: Stock price volatility increased during the credit

Q17: The Sharpe index measures the

A)average return on

Q18: Stock prices of U.S. firms primarily involved

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents