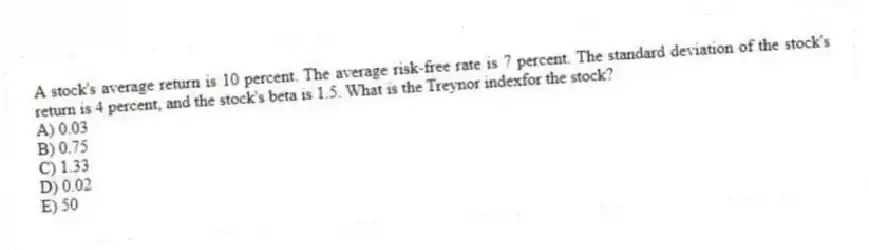

A stock's average return is 10 percent. The average risk-free rate is 7 percent. The standard deviation of the stock's return is 4 percent, and the stock's beta is 1.5. What is the Treynor indexfor the stock?

A) 0.03

B) 0.75

C) 1.33

D) 0.02

E) 50

Correct Answer:

Verified

Q1: The PE method to stock valuation may

Q5: The _ is commonly used as a

Q9: Bolwork Inc. is expected to pay a

Q10: A weak dollar may enhance the value

Q11: If security markets are semistrong-form efficient, investors

Q12: If security prices fully reflect all market-related

Q15: The expected acquisition of a firm typically

Q16: A stock's average return is 11 percent.

Q17: The Sharpe index measures the

A)average return on

Q19: The price-earnings valuation method applies the _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents