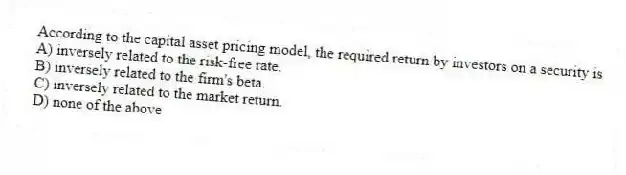

According to the capital asset pricing model, the required return by investors on a security is

A) inversely related to the risk-free rate.

B) inversely related to the firm's beta.

C) inversely related to the market return.

D) none of the above

Correct Answer:

Verified

Q31: LeBlanc Inc. currently has earnings of $10

Q32: Boris stock has an average return of

Q32: The standard deviation of a stock's returns

Q33: Zilo stock has an average return minus

Q34: The capital asset pricing model (CAPM) suggests

Q35: A higher beta for an asset reflects

A)

Q35: A beta of 1.1 means that for

Q38: Kandle Company paid a dividend of $4.76

Q40: Tarzak Inc. has earnings of $10 per

Q41: Which of the following is not commonly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents