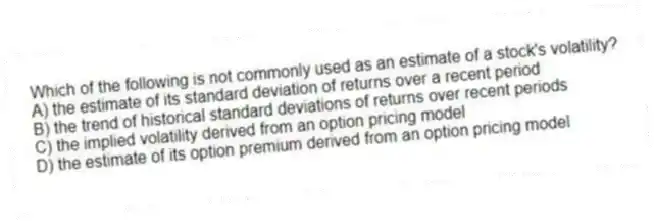

Which of the following is not commonly used as an estimate of a stock's volatility?

A) the estimate of its standard deviation of returns over a recent period

B) the trend of historical standard deviations of returns over recent periods

C) the implied volatility derived from an option pricing model

D) the estimate of its option premium derived from an option pricing model

Correct Answer:

Verified

Q32: The standard deviation of a stock's returns

Q35: A beta of 1.1 means that for

Q36: According to the capital asset pricing model,

Q38: Kandle Company paid a dividend of $4.76

Q40: Tarzak Inc. has earnings of $10 per

Q44: A stock portfolio has more volatility when

Q46: A relatively simple method of valuing a

Q53: The credit crisis caused major problems in

Q54: While the previous year's earnings are often

Q57: A stock has a standard deviation of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents