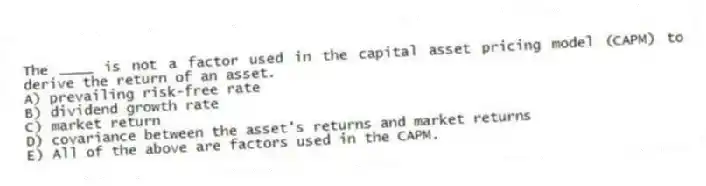

The ____ is not a factor used in the capital asset pricing model (CAPM) to derive the return of an asset.

A) prevailing risk-free rate

B) dividend growth rate

C) market return

D) covariance between the asset's returns and market returns

E) All of the above are factors used in the CAPM.

Correct Answer:

Verified

Q63: Beta serves as a measure of risk

Q75: Steam Corp. has a beta of 1.5.

Q77: _ are not a firm-specific factor that

Q78: The general mood of investors represents

A)investor sentiment.

B)beta.

C)systematic

Q80: If beta is thought to be the

Q80: Fabrizio, Inc. is expected to generate earnings

Q81: Holding other factors constant, an increase in

Q82: Holding other factors constant, a stock portfolio

Q84: VIX (CBOE Volatility Index) indicates the volatility

Q85: As a result of market integration, stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents