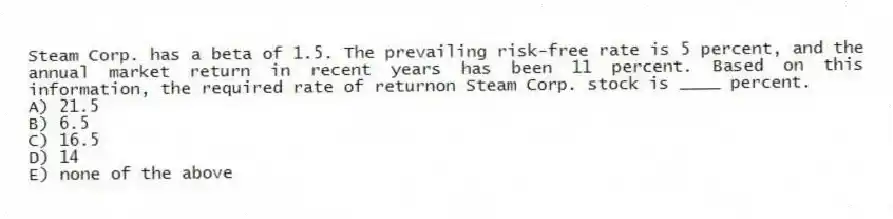

Steam Corp. has a beta of 1.5. The prevailing risk-free rate is 5 percent, and the annual market return in recent years has been 11 percent. Based on this information, the required rate of returnon Steam Corp. stock is ____ percent.

A) 21.5

B) 6.5

C) 16.5

D) 14

E) none of the above

Correct Answer:

Verified

Q61: Regarding the value-at-risk method, the same methods

Q62: Portfolio managers who monitor systematic risk rather

Q63: Beta serves as a measure of risk

Q68: A portfolio's beta is the sum of

Q77: _ are not a firm-specific factor that

Q78: The general mood of investors represents

A)investor sentiment.

B)beta.

C)systematic

Q79: Which of the following is not a

Q79: The _ is not a factor used

Q80: If beta is thought to be the

Q80: Fabrizio, Inc. is expected to generate earnings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents