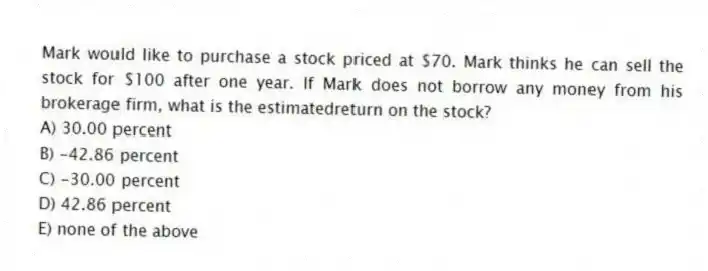

Mark would like to purchase a stock priced at $70. Mark thinks he can sell the stock for $100 after one year. If Mark does not borrow any money from his brokerage firm, what is the estimatedreturn on the stock?

A) 30.00 percent

B) -42.86 percent

C) -30.00 percent

D) 42.86 percent

E) none of the above

Correct Answer:

Verified

Q1: _ are enforced to restrict the amount

Q6: The risk of a short sale is

Q7: The short interest ratio is commonly measured

Q9: Assume that a stock is priced at

Q10: With a _ order, the investor specifies

Q12: You purchase a stock with cash, and

Q13: Assume a stock is initially priced at

Q15: When a brokerage firm demands more collateral

Q18: A _ order to buy or sell

Q19: The maintenance margin is the minimum amount

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents