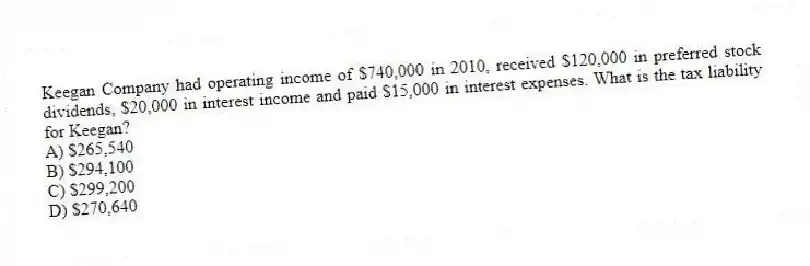

Keegan Company had operating income of $740,000 in 2010, received $120,000 in preferred stock dividends, $20,000 in interest income and paid $15,000 in interest expenses. What is the tax liability for Keegan?

A) $265,540

B) $294,100

C) $299,200

D) $270,640

Correct Answer:

Verified

Q9: All of the following about taxation of

Q10: Capital losses are

A) taxed at the same

Q11: How does a tax loss affect a

Q12: From a tax standpoint, the advantage of

Q13: Explain the difference between average tax rate

Q14: Intercompany dividends, or dividends paid by one

Q15: AMX corporation had operating income of $420,000

Q16: How are dividends received by a corporation

Q17: A corporation's net operating loss may be

Q19: What is the tax liability in 2010

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents