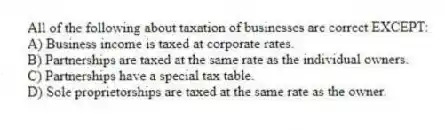

All of the following about taxation of businesses are correct EXCEPT:

A) Business income is taxed at corporate rates.

B) Partnerships are taxed at the same rate as the individual owners.

C) Partnerships have a special tax table.

D) Sole proprietorships are taxed at the same rate as the owner.

Correct Answer:

Verified

Q4: The marginal tax rate for a firm

Q5: Last year Cell 2 had a net

Q6: For most large U.S. corporations, the maximum

Q7: For a corporation with ordinary taxable income

Q8: Corporate capital gains income is currently taxed

Q10: Capital losses are

A) taxed at the same

Q11: How does a tax loss affect a

Q12: From a tax standpoint, the advantage of

Q13: Explain the difference between average tax rate

Q14: Intercompany dividends, or dividends paid by one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents