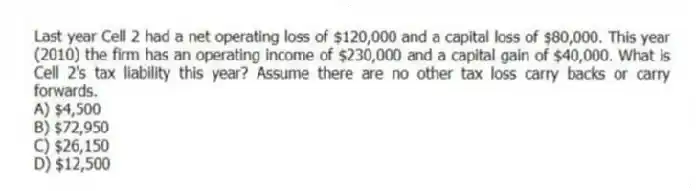

Last year Cell 2 had a net operating loss of $120,000 and a capital loss of $80,000. This year (2010) the firm has an operating income of $230,000 and a capital gain of $40,000. What is Cell 2's tax liability this year? Assume there are no other tax loss carry backs or carry forwards.

A) $4,500

B) $72,950

C) $26,150

D) $12,500

Correct Answer:

Verified

Q1: BET had a taxable income of $135,000

Q2: _ received by corporations are normally entitled

Q3: Using the rates in Appendix 2A, determine

Q4: The marginal tax rate for a firm

Q6: For most large U.S. corporations, the maximum

Q7: For a corporation with ordinary taxable income

Q8: Corporate capital gains income is currently taxed

Q9: All of the following about taxation of

Q10: Capital losses are

A) taxed at the same

Q11: How does a tax loss affect a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents