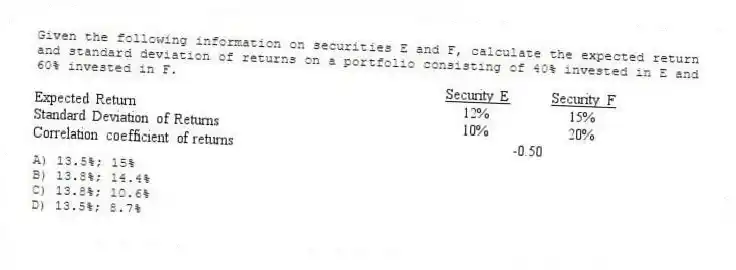

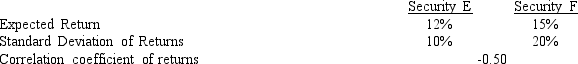

Given the following information on securities E and F, calculate the expected return and standard deviation of returns on a portfolio consisting of 40% invested in E and 60% invested in F.

A) 13.5%; 15%

B) 13.8%; 14.4%

C) 13.8%; 10.6%

D) 13.5%; 8.7%

Correct Answer:

Verified

Q84: Assume that the rate of return on

Q84: Gates Industries current common stock dividend (year

Q85: Jim Bowles is an investor who believes

Q87: Christy is considering investing in the common

Q90: HDTV has planned on diversifying into the

Q91: Lotte Group is planing on diversifying into

Q93: Total risk of a security can be

Q96: Determine the beta of a portfolio consisting

Q97: Security A offers an expected return of

Q98: Kermit Industries' current common stock dividend is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents