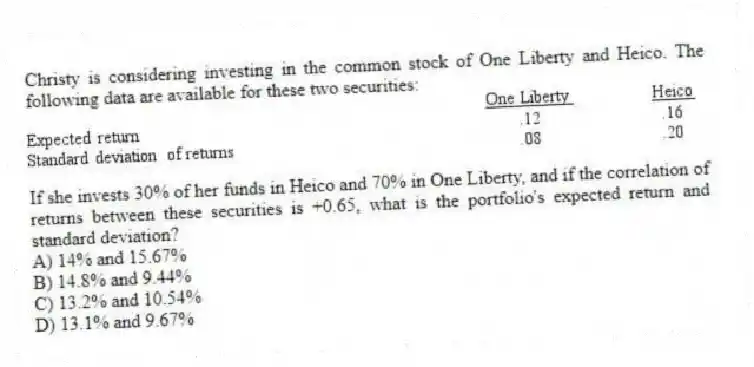

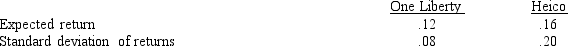

Christy is considering investing in the common stock of One Liberty and Heico. The following data are available for these two securities:

If she invests 30% of her funds in Heico and 70% in One Liberty, and if the correlation of returns between these securities is +0.65, what is the portfolio's expected return and standard deviation?

A) 14% and 15.67%

B) 14.8% and 9.44%

C) 13.2% and 10.54%

D) 13.1% and 9.67%

Correct Answer:

Verified

Q81: Richtex Brick has a current dividend of

Q82: Quick Start, Inc. is expected to pay

Q84: Correlation is a statistical measure of the

Q84: Assume that the rate of return on

Q85: Jim Bowles is an investor who believes

Q86: Determine the beta of a portfolio consisting

Q90: HDTV has planned on diversifying into the

Q91: An investor who believes the economy is

Q91: Lotte Group is planing on diversifying into

Q92: Given the following information on securities E

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents