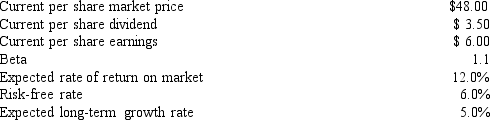

The following financial information is available on Rawls Manufacturing Company:

Rawls can issue new common stock to net the company $44 per share. Determine the cost of external equity capital using the dividend capitalization model approach. (Compute answer to the nearest 0.1%) .

A) 12.7%

B) 14.4%

C) 12.6%

D) 11.4%

Correct Answer:

Verified

Q41: Groves, Inc.pays an annual dividend of $1.22.This

Q47: Easy Slider Inc.sold a 15 year $1,000

Q53: What is the cost of a preferred

Q58: Weltron has a target capital structure of

Q59: What is the cost of equity for

Q61: Zappin' Skeeters Corporation needs to know its

Q63: Sharp's current capital structure of 60 percent

Q64: Sadaplast has a target capital structure of

Q65: The cost of debt must account for

Q79: California Best (CB), a sport shoe store,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents