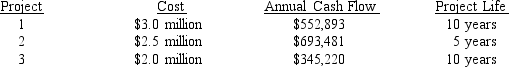

Sharp's current capital structure of 60 percent equity, 35 percent debt, and 5 percent preferred stock is considered optimal. This year Sharp expects to have earnings after tax of $3.6 million and to pay out $600,000 in dividends. Sharp can also raise up to $2 million in long-term debt at a pretax interest rate of 10.6 percent (all debt over $2 million will cost 11.4% pretax) , and sell preferred stock at a cost of 11.5 percent. Sharp's marginal tax rate is 40 percent. The current value of Sharp's common stock is $36 and a dividend of $2.15 is expected to be paid during the coming year. Dividends have been growing at an annual compound rate of 8 percent a year and are expected to continue growing at that rate. New shares can be sold to net the firm $34.50. Sharp has an opportunity to invest in the following capital projects. Which one(s) should be accepted?

A) 1 and 2

B) 1 and 3

C) 1, 2, and 3

D) cannot be determined from the information provided

Correct Answer:

Verified

Q53: What is the cost of a preferred

Q58: Weltron has a target capital structure of

Q60: The following financial information is available on

Q61: Zappin' Skeeters Corporation needs to know its

Q64: Sadaplast has a target capital structure of

Q65: The cost of debt must account for

Q66: There are two primary ways that capital

Q67: Far Out Tech (FOT) has a debt

Q67: Wright Express (WE) has a capital structure

Q79: California Best (CB), a sport shoe store,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents