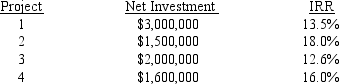

Far Out Tech (FOT) has a debt ratio of 0.3 and it considers this to be its optimal capital structure. FOT has no preferred stock. FOT has analyzed four capital projects for the coming year as follows:

FOT expects to earn $2.7 million after tax next year and pay out $700,000 in dividends. Dividends are expected to be $1.05 a share during the coming year and are expected to grow at a constant rate of 10 percent a year for the foreseeable future. The current market price of FOT stock is $22 and up to $2 million in new equity can be raised for a flotation cost of 10 percent. If more than $2 million is sold then the flotation cost will be 15 percent. Up to $2 million in debt can be sold at par with a coupon rate of 10 percent. Any debt over $2 million will carry a 12 percent coupon rate and be sold at par. If FOT has a marginal tax rate of 40 percent, in which projects should it invest?

A) 1, 2, 3, & 4

B) 2

C) 1, 2, and 4

D) 2 and 4

Correct Answer:

Verified

Q53: Haulsee Inc.pays no dividend currently but is

Q63: Sharp's current capital structure of 60 percent

Q64: Sadaplast has a target capital structure of

Q65: The cost of debt must account for

Q66: There are two primary ways that capital

Q67: Wright Express (WE) has a capital structure

Q69: Investors can form earnings growth expectations from

Q71: Bay State Technology has determined that its

Q72: What is the weighted average cost of

Q79: California Best (CB), a sport shoe store,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents