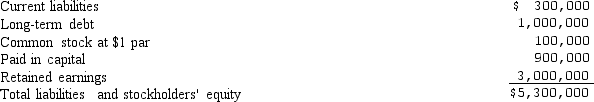

Bay State Technology has determined that its cost of equity is 15% and its after-tax cost of debt is 7.2%. Bay State expects to earn $14 million after taxes next year and, as a new firm, does not pay any dividends. The stock sells for $24. Bonds are currently selling at par value. Compute Bay State's weighted cost of capital. A partial balance sheet is shown below:

A) 13.4%

B) 13.1%

C) 11.6%

D) 12.7%

Correct Answer:

Verified

Q53: Haulsee Inc.pays no dividend currently but is

Q66: There are two primary ways that capital

Q66: Columbia Gas Company's (CG) current capital structure

Q67: Wright Express (WE) has a capital structure

Q67: Far Out Tech (FOT) has a debt

Q69: Investors can form earnings growth expectations from

Q72: What is the weighted average cost of

Q74: American Dental Laser is selling a 10

Q75: Mahlo is planing to diversify into the

Q76: Whipple Industries, Inc. is in the process

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents