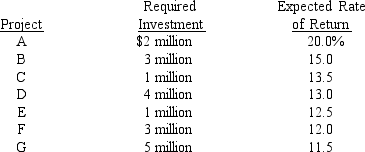

Whipple Industries, Inc. is in the process of determining its optimal capital budget for next year. The following investment projects are under consideration:

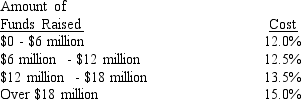

The firm's marginal cost of capital schedule is as follows:

Determine Whipple's optimal capital budget (in dollars) for the coming year.

A) $11 million

B) $10 million

C) $5 million

D) $14 million

Correct Answer:

Verified

Q62: Heleveton Industries is 100% equity financed. Its

Q66: Columbia Gas Company's (CG) current capital structure

Q71: Bay State Technology has determined that its

Q72: What is the weighted average cost of

Q72: Mid-States Utility Company just issued at $3.20

Q72: Temple Company's common stock dividends have grown

Q74: American Dental Laser is selling a 10

Q75: Mahlo is planing to diversify into the

Q78: Which of the following statements regarding the

Q86: What is Bodacious Bodywear's weighted average cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents