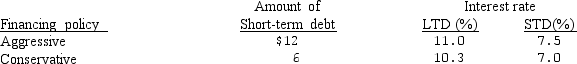

Laserscope Inc. is trying to determine the best combination of short-term and long-term debt to employ in financing its assets. Laserscope will have $16 million in current assets and $20 million in fixed assets next year and expects operating income (EBIT) to be $4.1 million. The company's tax rate is 40% and its debt ratio is 50%. The firm's debt will be financed by one of the following policies:

What is the return on shareholder's equity under each policy?

A) aggressive = 12.70% & conservative = 12.22%

B) aggressive = 8.47% & conservative = 8.14%

C) aggressive = 4.23% & conservative = 4.07%

D) aggressive = 7.67% & conservative = 8.81%

Correct Answer:

Verified

Q45: Sherwood Packing had sales of $3.2 million

Q50: Simmons Industries is considering two alternative working

Q50: What is the inventory conversion period for

Q51: What is the length of the cash

Q52: If a firm shows a profit on

Q53: Laserscope has an inventory conversion period of

Q54: Cisco Systems wishes to analyze the joint

Q57: If Swatch's inventory conversion period is 45

Q59: Barnes Company has highly seasonal sales and

Q72: What are accrued expenses and how are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents