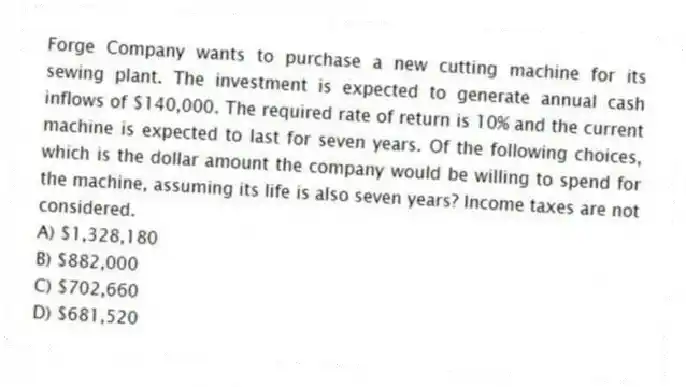

Forge Company wants to purchase a new cutting machine for its sewing plant. The investment is expected to generate annual cash inflows of $140,000. The required rate of return is 10% and the current machine is expected to last for seven years. Of the following choices, which is the dollar amount the company would be willing to spend for the machine, assuming its life is also seven years? Income taxes are not considered.

A) $1,328,180

B) $882,000

C) $702,660

D) $681,520

Correct Answer:

Verified

Q27: Assume your goal in life is to

Q28: Net present value is calculated using which

Q29: Diemia Hospital has been considering the purchase

Q30: Cast Iron Stove Company wants to buy

Q31: The net present value method focuses on

Q33: Concose Park Department is considering a new

Q34: Which of the following methods is described

Q35: Difend Cleaners has been considering the purchase

Q36: Diemia Hospital has been considering the purchase

Q37: In using the net present value method,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents