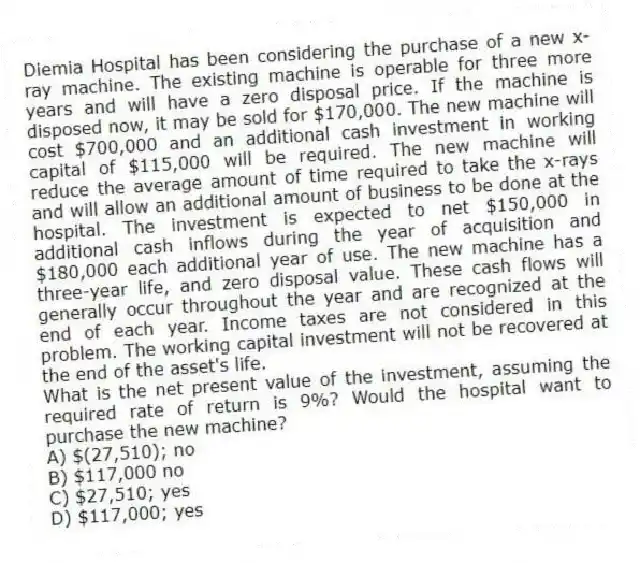

Diemia Hospital has been considering the purchase of a new x-ray machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $170,000. The new machine will cost $700,000 and an additional cash investment in working capital of $115,000 will be required. The new machine will reduce the average amount of time required to take the x-rays and will allow an additional amount of business to be done at the hospital. The investment is expected to net $150,000 in additional cash inflows during the year of acquisition and $180,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment, assuming the required rate of return is 9%? Would the hospital want to purchase the new machine?

A) $(27,510) ; no

B) $117,000 no

C) $27,510; yes

D) $117,000; yes

Correct Answer:

Verified

Q31: The net present value method focuses on

Q32: Forge Company wants to purchase a new

Q33: Concose Park Department is considering a new

Q34: Which of the following methods is described

Q35: Difend Cleaners has been considering the purchase

Q37: In using the net present value method,

Q38: Which of the following is another term

Q39: An annuity is _.

A) a noncash expense

B)

Q40: The Zeron Corporation wants to purchase a

Q41: Hypore Darby Park Department is considering a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents