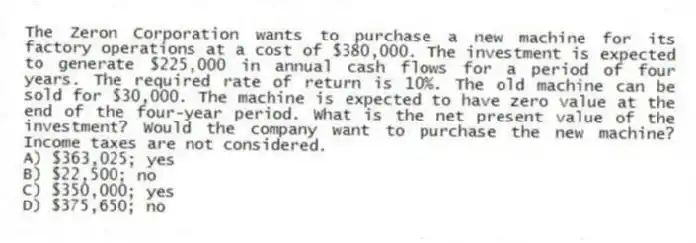

The Zeron Corporation wants to purchase a new machine for its factory operations at a cost of $380,000. The investment is expected to generate $225,000 in annual cash flows for a period of four years. The required rate of return is 10%. The old machine can be sold for $30,000. The machine is expected to have zero value at the end of the four-year period. What is the net present value of the investment? Would the company want to purchase the new machine? Income taxes are not considered.

A) $363,025; yes

B) $22,500; no

C) $350,000; yes

D) $375,650; no

Correct Answer:

Verified

Q35: Difend Cleaners has been considering the purchase

Q36: Diemia Hospital has been considering the purchase

Q37: In using the net present value method,

Q38: Which of the following is another term

Q39: An annuity is _.

A) a noncash expense

B)

Q41: Hypore Darby Park Department is considering a

Q42: A general rule in capital budgeting is

Q43: Which of the following best explains why

Q44: A "what-if" technique that examines how a

Q45: In situations where the required rate of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents