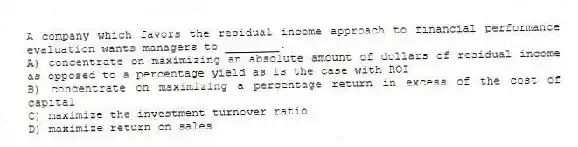

A company which favors the residual income approach to financial performance evaluation wants managers to ________.

A) concentrate on maximizing an absolute amount of dollars of residual income as opposed to a percentage yield as is the case with ROI

B) concentrate on maximizing a percentage return in excess of the cost of capital

C) maximize the investment turnover ratio

D) maximize return on sales

Correct Answer:

Verified

Q41: Springfield Corporation, whose tax rate is 34%,

Q42: Springfield Corporation, whose tax rate is 30%,

Q43: Care Inc., has two divisions that operate

Q44: Times Corporation, whose tax rate is 30%,

Q45: Waldorf Company has two sources of funds:

Q47: Coldbrook Company has two sources of funds:

Q48: Which of the following is the required

Q49: The required rate of return multiplied by

Q50: Waldorf Company has two sources of funds:

Q51: Care Inc., has two divisions that operate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents