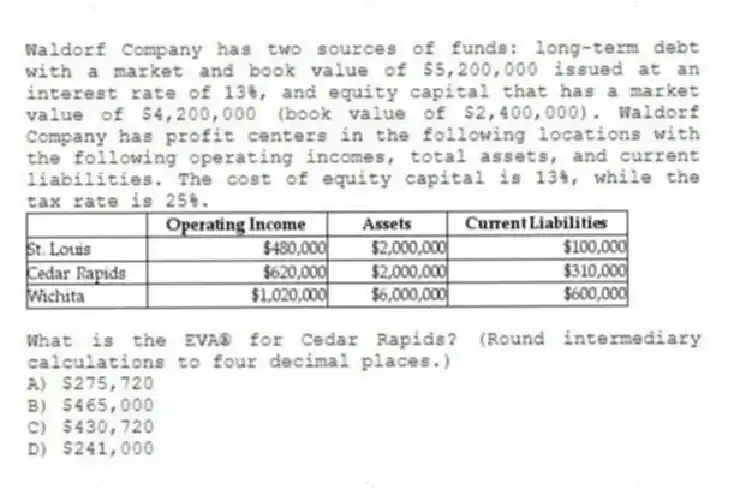

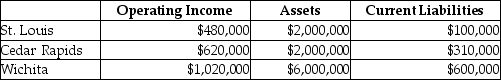

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places.)

A) $275,720

B) $465,000

C) $430,720

D) $241,000

Correct Answer:

Verified

Q45: Waldorf Company has two sources of funds:

Q46: A company which favors the residual income

Q47: Coldbrook Company has two sources of funds:

Q48: Which of the following is the required

Q49: The required rate of return multiplied by

Q51: Care Inc., has two divisions that operate

Q52: Which of the following is a performance

Q53: Care Inc., has two divisions that operate

Q54: Waldorf Company has two sources of funds:

Q55: Using residual income as a measure of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents