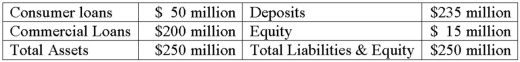

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

A) 1,630 contracts.

B) 1,475 contracts.

C) 1,900 contracts.

D) 2,078 contracts.

E) 3,225 contracts.

Correct Answer:

Verified

Q66: When will the estimated hedge ratio be

Q81: The average duration of the loans is

Q82: Use the following two choices to identify

Q82: Selling a credit forward agreement generates a

Q83: Conyers Bank holds Treasury bonds with a

Q85: Conyers Bank holds Treasury bonds with a

Q86: Conyers Bank holds Treasury bonds with a

Q87: Conyers Bank holds Treasury bonds with a

Q88: Use the following two choices to identify

Q89: Use the following two choices to identify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents