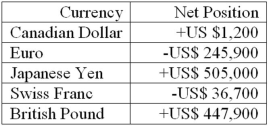

The following are the net currency positions of a U.S. FI (stated in U.S. dollars) . Note: Net currency positions are foreign exchange bought minus foreign exchange sold restated in U.S. dollar terms.  How would you characterize the FI's risk exposure to fluctuations in the Euro to dollar exchange rate?

How would you characterize the FI's risk exposure to fluctuations in the Euro to dollar exchange rate?

A) The FI is net short in the Euro and therefore faces the risk that the Euro will rise in value against the U.S. dollar.

B) The FI is net short in the Euro and therefore faces the risk that the Euro will fall in value against the U.S. dollar.

C) The FI is net long in the Euro and therefore faces the risk that the Euro will fall in value against the U.S. dollar.

D) The FI is net long in the Euro and therefore faces the risk that the Euro will rise in value against the U.S. dollar.

E) The FI has a balanced position in the Euro.

Correct Answer:

Verified

Q66: Suppose that the current spot exchange rate

Q67: The following are the net currency positions

Q68: Suppose that the current spot exchange rate

Q69: The following are the net currency positions

Q72: The following are the net currency positions

Q73: The one-year CD rates for financial institutions

Q75: The following are the net currency positions

Q90: Your U.S.bank issues a one-year U.S.CD at

Q93: Your U.S.bank issues a one-year U.S.CD at

Q100: Your U.S.bank issues a one-year U.S.CD at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents