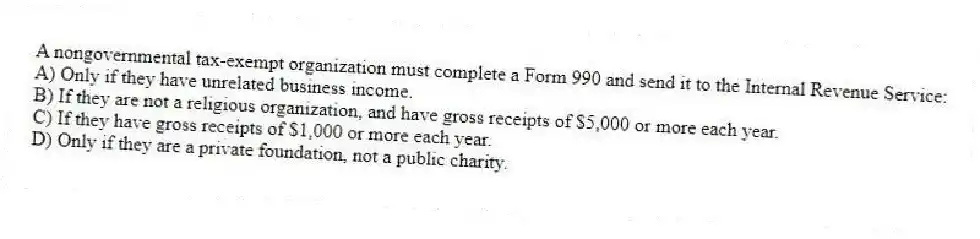

A nongovernmental tax-exempt organization must complete a Form 990 and send it to the Internal Revenue Service:

A) Only if they have unrelated business income.

B) If they are not a religious organization, and have gross receipts of $5,000 or more each year.

C) If they have gross receipts of $1,000 or more each year.

D) Only if they are a private foundation, not a public charity.

Correct Answer:

Verified

Q18: The not-for-profit organization applying for tax-exempt status

Q19: Political parties and campaign committees can qualify

Q20: One of the limitations of financial ratio

Q21: Not-for-profit organizations are required to file audited

Q22: A tax-exempt organization that receives its support

Q24: A not-for-profit typically has gross receipts of

Q25: A disqualified person is a person who

Q26: A good measure of whether a not-for-profit

Q27: The organization Shelter the Needy is completing

Q28: The Internal Revenue Service may impose intermediate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents