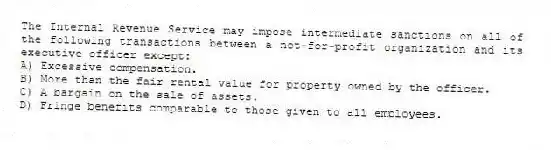

The Internal Revenue Service may impose intermediate sanctions on all of the following transactions between a not-for-profit organization and its executive officer except:

A) Excessive compensation.

B) More than the fair rental value for property owned by the officer.

C) A bargain on the sale of assets.

D) Fringe benefits comparable to those given to all employees.

Correct Answer:

Verified

Q23: A nongovernmental tax-exempt organization must complete a

Q24: A not-for-profit typically has gross receipts of

Q25: A disqualified person is a person who

Q26: A good measure of whether a not-for-profit

Q27: The organization Shelter the Needy is completing

Q29: The success of a not-for-profit organization is

Q30: A good measure that can be used

Q31: The lack of defined ownership for not-for-profit

Q32: Public disclosure rules require that a tax-exempt

Q33: The income most likely to be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents