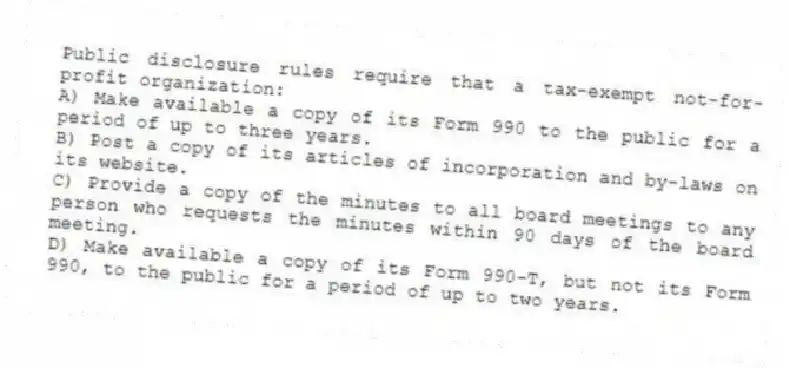

Public disclosure rules require that a tax-exempt not-for-profit organization:

A) Make available a copy of its Form 990 to the public for a period of up to three years.

B) Post a copy of its articles of incorporation and by-laws on its website.

C) Provide a copy of the minutes to all board meetings to any person who requests the minutes within 90 days of the board meeting.

D) Make available a copy of its Form 990-T, but not its Form 990, to the public for a period of up to two years.

Correct Answer:

Verified

Q27: The organization Shelter the Needy is completing

Q28: The Internal Revenue Service may impose intermediate

Q29: The success of a not-for-profit organization is

Q30: A good measure that can be used

Q31: The lack of defined ownership for not-for-profit

Q33: The income most likely to be considered

Q34: A large not-for-profit organization expended $1,250,000 in

Q35: A program effectiveness ratio is helpful in

Q36: The term that means information skewed toward

Q37: Income, a not-for-profit organization, earns from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents