Currently.the price of consuming housing  is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from

is lowered by the fact that home mortgage interest is tax deductible.Suppose the government proposed to eliminate this implicit subsidy of your housing consumption, raising the price from  to

to  .At the same time, the government lowers the tax on other consumption, lowering the price from

.At the same time, the government lowers the tax on other consumption, lowering the price from  to

to  .

.

a.Write down your original budget constraint assuming the consumer has income I.

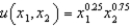

b.Suppose the utility function  captures your tastes, and suppose

captures your tastes, and suppose  ,

,  ,

,  ,

,  and

and  .Write out the utility maximization problem for this consumer prior to any policy change.

.Write out the utility maximization problem for this consumer prior to any policy change.

c.How much housing and other goods will this consumer consume prior to any policy change?

d.How much would this consumer be willing to pay to get the policy change implemented?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: You and I both have homothetic tastes.When

Q18: Bottles of Coca-Cola and equally-sized bottles of

Q19: The price of peaches goes up and

Q20: At most museums, you can either buy

Q21: Your drink budget is entirely split between

Q22: Suppose a relatively low income family has

Q23: Suppose the only two goods you care

Q25: Suppose the government spends the same for

Q26: Suppose you collect stamps and coins for

Q27: Suppose your tastes are defined by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents