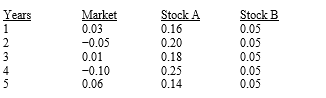

You have developed data which give (1) the average annual returns on the market for the past five years,and (2) similar information on Stocks A and B.If these data are as follows,which of the possible answers best describes the historical betas for A and B?

A) βA > 0;βB = 1

B) βA > +1;βB = 0

C) βA = 0;βB = −1

D) βA < 0;βB = 0

E) βA < −1;βB = 1

Correct Answer:

Verified

Q33: Which of the following statements is most

Q35: Which of the following statements is most

Q39: Which of the following is not a

Q40: You are an investor in common stock,and

Q42: Company X has beta = 1.6,while Company

Q43: ABC Company has been growing at a

Q63: Calculate the required rate of return for

Q70: You are holding a stock which has

Q79: Other things held constant, (1) if the

Q80: Which of the following statements is most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents