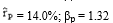

You are an investor in common stock,and you currently hold a well-diversified portfolio which has an expected return of 12 percent,a beta of 1.2,and a total value of $9,000.You plan to increase your portfolio by buying 100 shares of AT&E at $10 a share.AT&E has an expected return of 20 percent with a beta of 2.0.What will be the expected return and the beta of your portfolio after you purchase the new stock?

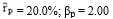

A)

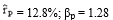

B)

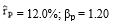

C)

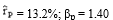

D)

E)

Correct Answer:

Verified

Q35: Which of the following statements is most

Q38: You have developed data which give (1)the

Q39: Which of the following is not a

Q42: Company X has beta = 1.6,while Company

Q43: ABC Company has been growing at a

Q44: Given the following information,calculate the expected capital

Q45: A financial analyst has been following Fast

Q63: Calculate the required rate of return for

Q70: You are holding a stock which has

Q79: Other things held constant, (1) if the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents