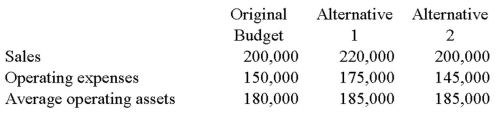

Mari Inc.'s managers are considering alternative strategies to see if it is possible to improve ROI from that originally budgeted for the coming year.Alternative 1 has more money spent on advertising to increase sales while alternative 2 includes reductions of a number of operating expenses.Adjustments to operating assets are anticipated in each of the two alternatives as well.The numbers as in the original budget and in the two alternatives are set out below:  What is the relative ranking based upon ROI of the above three choices (highest to lowest) ?

What is the relative ranking based upon ROI of the above three choices (highest to lowest) ?

A) Original Budget,Alternative 1,Alternative 2.

B) Alternative 1,Alternative 2,Original Budget.

C) Alternative 2,Original Budget,Alternative 1.

D) Original Budget,Alternative 2,Alternative 1.

Correct Answer:

Verified

Q87: Jimbob Co.has three operating divisions with the

Q90: Which of the following are potential benefits

Q93: For the past year,residual income was?

A) $0.

B)

Q95: For the past year,the return on investment

Q107: The Millard Division's operating data for the

Q115: The Millard Division's operating data for the

Q117: The Millard Division's operating data for the

Q183: Financial data for Bingham Company for

Q184: Financial data for Beaker Company for

Q188: The following data have been extracted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents