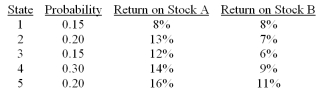

Consider the following probability distribution for stocks A and B:  The expected rates of return of stocks A and B are _____ and _____, respectively.

The expected rates of return of stocks A and B are _____ and _____, respectively.

A) 13.2%; 9%

B) 13%; 8.4%

C) 13.2%; 7.7%

D) 7.7%; 13.2%

Correct Answer:

Verified

Q22: Portfolio theory as described by Markowitz is

Q38: Consider the following probability distribution for stocks

Q39: Which one of the following portfolios cannot

Q41: The global minimum variance portfolio formed from

Q42: Consider the following probability distribution for stocks

Q45: The individual investor's optimal portfolio is designated

Q46: Given an optimal risky portfolio with expected

Q48: When two risky securities that are positively

Q48: For a two-stock portfolio, what would be

Q57: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents