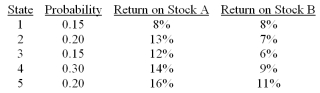

Consider the following probability distribution for stocks A and B:  The standard deviations of stocks A and B are _____ and _____, respectively.

The standard deviations of stocks A and B are _____ and _____, respectively.

A) 1.56%; 1.99%

B) 2.45%; 1.66%

C) 3.22%; 2.01%

D) 1.54%; 1.11%

Correct Answer:

Verified

Q22: Portfolio theory as described by Markowitz is

Q37: An investor who wishes to form a

Q38: Consider the following probability distribution for stocks

Q39: Which one of the following portfolios cannot

Q41: The global minimum variance portfolio formed from

Q43: Consider the following probability distribution for stocks

Q45: The individual investor's optimal portfolio is designated

Q46: Given an optimal risky portfolio with expected

Q48: When two risky securities that are positively

Q57: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents