Moss Manufacturing has just completed a major change in its quality control (QC) process. Previously, products had been reviewed by QC inspectors at the end of each major process, and the company's ten QC inspectors were charged as direct labor to the operation or job. In an effort to improve efficiency and quality, a computerized video QC system was purchased for $250,000. The system consists of a minicomputer, 15 video cameras, other peripheral hardware, and software.

The new system used cameras stationed by QC engineers at key points in the production process. Each time an operation changes or there is a new operation, the cameras are moved, and a new master picture is loaded into the computer by a QC engineer. The camera takes pictures of the units in process, and the computer compares them to the picture of a "good" unit. Any differences are sent to a QC engineer who removes the bad units and discusses the flaws with the production supervisors. The new system has replaced the ten QC inspectors with two QC engineers.

The operating costs of the new QC system, including the salaries of the QC engineers, have been included as factory overhead in calculating the company's volume-based factory overhead rate which is based on direct labor dollars.

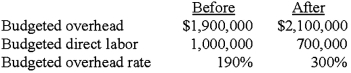

The company's president is confused. His vice president of production has told him how efficient the new system is, yet there is a large increase in the factory overhead rate. The computation of the rate before and after automation is shown below.  "Three hundred percent," lamented the president, "How can we compete with such a high factory overhead rate?"

"Three hundred percent," lamented the president, "How can we compete with such a high factory overhead rate?"

Required:

1. a. Define factory overhead, and cite three examples of typical costs that would be included in factory overhead.

b. Explain why companies develop factory overhead rates.

2. Explain why the increase in the overhead rate should not have a negative financial impact on Moss Manufacturing.

3. Explain, in the greatest detail possible, how Moss Manufacturing could change its overhead accounting system to eliminate confusion over product costs.

Correct Answer:

Verified

Feedback: 1. a. Factory ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Plant overhead for ABC Corp in $150

Q134: Nerrod Company sells its products at $500

Q137: The controller for Alabama Cooking Oil Co.

Q138: Service and not-for-profit organizations often:

A)Have ABC systems

Q141: Customer Profitability Analysis Boston Depot sells office

Q142: Certo Health Products was formed two years

Q143: Customer Profitability Analysis Spring Company collected the

Q144: Volume-Based Costing Versus ABC: Gorden Company produces

Q146: The controller for Ocean Sailboats Inc., a

Q147: Cost Pools and Cost Drivers Based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents