Customer Profitability Analysis Boston Depot sells office supplies to area corporations and organizations. Tom Delayne, founder and CEO, has been disappointed with the operating results and the profit margin for the last two years. Business forms are mostly a "commodity" business with low profit margins. To increase profit margins and gain competitive advantages, Delayne introduced "Desk-Top Delivery" service. The business seems to be as busy as ever. Yet, the operating income has been declining. To help identify the root cause of declining profits, he decided to analyze the profitability of two of the firm's major customers: Omega International (OI) and City of Albion (CA).

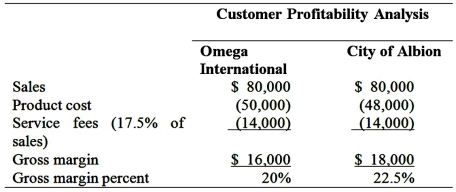

According to the customer profitability analysis that Boston Depot conducts regularly, Boston Depot has the same amount of total sales with both OI and CA. However, the firm earns a higher gross margin and gross margin ratio from CA than those from the sales to OI, as demonstrated here:

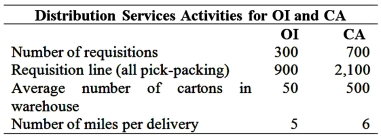

Boston Depot adds a flat 17.5 percent to all sales for expenses incurred in such activities as handling customers' requests, pick-packing, order delivery, warehousing, and data entry. However, not all customers require the same level of services. Operation Manager, Jamie Steel, points out that CA has been a much heavier service user than OI. She shows the following data to support her belief:

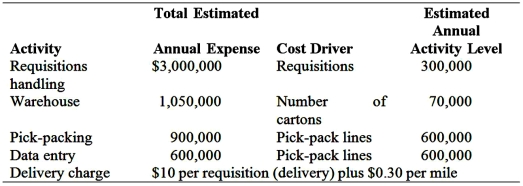

Boston Depot adds a flat 17.5 percent to all sales for expenses incurred in such activities as handling customers' requests, pick-packing, order delivery, warehousing, and data entry. However, not all customers require the same level of services. Operation Manager, Jamie Steel, points out that CA has been a much heavier service user than OI. She shows the following data to support her belief:  Controller Rod Jay has been investigating ways to determine the costs of performing various activities. He summarized his findings:

Controller Rod Jay has been investigating ways to determine the costs of performing various activities. He summarized his findings:  Steel points out that activities cost money. Two customers who request different service activities most likely are not costing the firm the same.

Steel points out that activities cost money. Two customers who request different service activities most likely are not costing the firm the same.

Required:

1. Using activity-based costing, compute the charges per unit of service activities.

2. Using activity-based costing, compute the total distribution costs for each of the customers.

3. Is the City of Albion a more profitable customer?

4. Is Omega International a better customer for Boston Depot?

Correct Answer:

Verified

Feedback: 1. Service cos...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Plant overhead for ABC Corp in $150

Q133: Scott Cameras produces digital cameras and have

Q134: Nerrod Company sells its products at $500

Q137: The controller for Alabama Cooking Oil Co.

Q138: Service and not-for-profit organizations often:

A)Have ABC systems

Q142: Moss Manufacturing has just completed a major

Q142: Certo Health Products was formed two years

Q143: Customer Profitability Analysis Spring Company collected the

Q144: Volume-Based Costing Versus ABC: Gorden Company produces

Q146: The controller for Ocean Sailboats Inc., a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents